Staring into the maw of the AI slop vortex

It's like when Steve Carrell goes to Florida in "The Big Short", but for dumb internet content

There’s a great scene in The Big Short where Mark Baum goes to Florida with his team to find out, firsthand, if there really is a housing bubble. After seeing a few abandoned developments with alligators in swimming pools and meeting strippers with 5 mortgages, it seems pretty obvious what’s going on.

It’s a totally different approach to Michael Burry, who finds out by staying at his desk to scour spreadsheets and study the numbers.

This month, Goldman Sachs has announced that they, like Dr Burry, have been studying the numbers as well. Their conclusion? It’s time to start calling bullshit. (Sequoia have done similar.)

But what if you want a more Floridian, Mark Baum-esque experience?

Reader, I had one: an AI-for-marketing company tried to get me to pay $24,000 a year for a product the salesperson openly admitted wasn't very good, on the basis that I could use it to produce 85 shitty blog posts a month, equivalent to a thousand a year.

Welcome to the internet’s AI slop vortex! Get the whole story here.

PS: what we talk about when we talk about AI

Many of us (i.e. me) fall into the trap of talking about AI as if it’s one big monolith. It isn’t. There are a lot of ways we can dice it but I think it’s worth dividing it into at least two different categories here:

Deep tech AI: people working directly with AI and ML models, usually free (open source) + compute costs, and usually to do difficult/technical things

Consumer tech AI: a frothing mix of sometimes useful but mostly nonsense hype and vaporware found in both B2C and B2B contexts

If there’s a bubble anywhere, it feels like it’s gonna be in Category 2. There is, after all, a world of difference between Google’s shitty AI search feature and scientists using AlphaFold.

Compartmentalized decoy optimization

I’ve long been fascinated by productivity culture. Wait, no: I’ve long been a sucker for it. And why not? It promises so much:

Ingest productivity content

Follow simple steps

????

Profit!

But it never really works, does it? If anything you just end up stuck in Step 1, doing some of Step 2, then cycling immediately back to Step 1. That’s why there are oceans of productivity content out there.

I’ve been trying to put my finger on why, so I sat down and wrote about it.

Are the carnivore diet people doing okay?

The creators are unironically just doing none pizza with left beef now, I guess? Carnivore diets have felt like a thing for a while, ever since The Liver King had his rise into mainstream consciousness (and eventual fall from grace).

Decidedly less organ-fixated, Coach Carnivore Cam has been showing up in my YouTube algo for a couple of weeks now, mostly because I can’t tear my eyes away from what he’s eating. He gets relentlessly shredded in the comments but keeps pumping out more and more videos anyway.

This is presumably so he can sell personalised meal plans for £199 each—there’s always a digital product hiding in there somewhere! We can only imagine what grim horrors lie within.

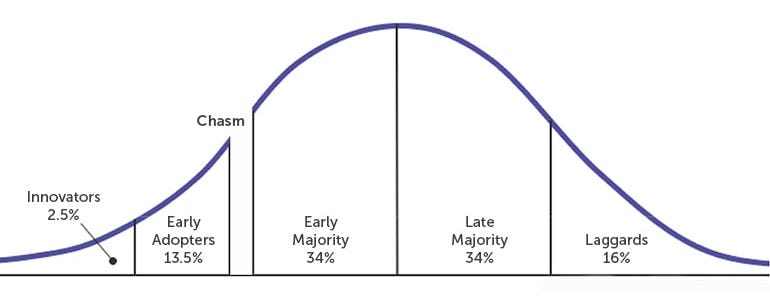

Crossing the chasm

I recently posted my book notes for Crossing the Chasm by Geoffrey A Moore.

Here’s the TL;DR:

New technology appears and gets adopted by tech enthusiasts

These enthusiasts then tell their less-technical-but-bigger-picture-seeing friends who find ways to turn this new tech to their advantage

This adoption eventually stalls because it can’t translate to more mainstream audiences

This mostly happens because you need to communicate different types of value to the five different psychographic groups and have “the whole product” available with a very clear use case. Those who fail to do this never make it.

The book is mostly about tech products with a bias towards B2B, but I couldn’t help thinking about these ideas in the context of crypto. Originally, people got into Bitcoin because it was technically interesting (do you like reading white papers?). So, the tech enthusiast types got on board with it.

Then, when Bitcoin pumped super hard in late 2020, it felt like it was the jump into early adopters with the promise of the vision of what it could do and be for society, etc. With the eventual crypto winter/crash in value in 2022, the vision hadn’t materialized and it never made it into mainstream adoption.

But now Bitcoin is somehow back in “All Time High” (ATH) territory, hovering around the $64k mark. This time around it feels much harder to tell why. Does this mean the chasm has finally been crossed?

I have no idea! Find my book notes here.

That’s a ten

Thanks for reading to the end. I’m still figuring out what this newsletter should be, and why, but thanks for sticking with me.

I’ll leave you with one of my all-time favourite YouTube videos: professional ice cream taste tester John Harrison, just really enjoying some vanilla ice cream. That’s a ten!